BTC Price Prediction: Navigating Short-Term Volatility Toward Long-Term Growth Trajectory

#BTC

- Technical indicators show short-term consolidation with MACD suggesting potential trend reversal

- Institutional accumulation by major corporations provides strong fundamental support

- Long-term adoption narrative remains intact despite recent volatility and liquidations

BTC Price Prediction

Technical Analysis: BTC Shows Mixed Signals Near Key Support Level

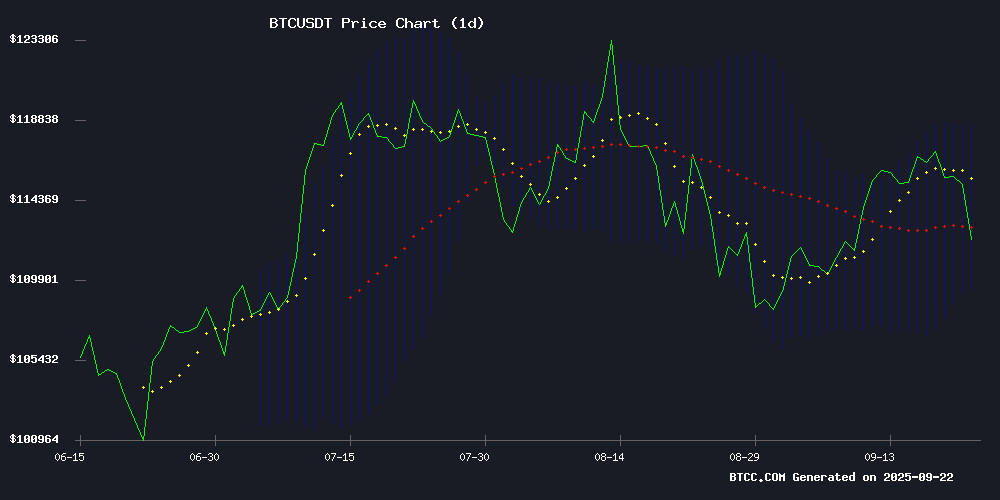

BTC is currently trading at $112,194.25, slightly below the 20-day moving average of $113,954.81, indicating potential short-term weakness. The MACD reading of -3,064.24 remains in negative territory, though the histogram shows decreasing bearish momentum. Price action is hovering NEAR the middle Bollinger Band, with support at $109,339.96 and resistance at $118,569.67. According to BTCC financial analyst Michael, 'The current technical setup suggests consolidation around these levels, with a break below the lower Bollinger Band potentially triggering further downside toward $105,000.'

Market Sentiment: Institutional Accumulation Offsets Short-Term Volatility Concerns

Despite recent price weakness below $112,000, institutional demand remains robust as evidenced by Metaplanet's $632 million purchase and MicroStrategy's continued accumulation. The $1.7 billion liquidation event has created temporary pressure, but long positioning on Bitfinex suggests underlying bullish conviction. Coinbase's transformation into a financial superapp and CEO Brian Armstrong's $1 million prediction by 2030 reflect strong fundamental tailwinds. BTCC financial analyst Michael notes, 'While bond yield movements have triggered risk-off sentiment, the structural adoption story remains intact with corporations and governments increasingly treating Bitcoin as a strategic asset.'

Factors Influencing BTC's Price

Coinbase CEO Predicts Bitcoin Could Reach $1 Million by 2030 Citing ETFs, Regulation, and Government Demand

Brian Armstrong, CEO of Coinbase, remains unfazed by short-term market volatility, projecting Bitcoin could hit $1 million by 2030. His bullish outlook hinges on three catalysts: the seismic impact of spot Bitcoin ETFs, regulatory milestones like the Genius Act, and growing institutional adoption by governments.

"Bitcoin is evolving into digital gold," Armstrong noted during a Fox Business interview, dismissing traditional correlations between Fed rate cuts and crypto performance. The potential creation of a U.S. strategic Bitcoin reserve could trigger a domino effect among G20 nations, creating unprecedented demand.

Metaplanet Expands Bitcoin Treasury with $632M Purchase, Nearing 2025 Accumulation Target

Metaplanet Inc., Japan's foremost corporate Bitcoin holder, has aggressively increased its exposure to the flagship cryptocurrency with a 5,419 BTC acquisition worth ¥93.6 billion ($632.53M). The purchase at ¥17.28M per BTC ($116,724) brings its total holdings to 25,555 BTC - equivalent to 85% of its stated 30,000 BTC target for 2025.

The firm's cumulative Bitcoin investment now stands at ¥398.2B ($2.71B) with an average cost basis of ¥15.58M ($106,065). At current prices of $114,575/BTC, Metaplanet's position is valued at $2.93B, reflecting a 10.3% yield since July 2025 as per its proprietary performance metrics.

This strategic accumulation underscores growing institutional conviction in Bitcoin's store-of-value proposition, particularly among Asian corporations seeking alternatives to weakening fiat currencies. The purchase follows a pattern of consistent buying, including a 136 BTC top-up just four days prior.

Crypto Market Tumbles as Bond Yields Signal Risk Aversion

Bitcoin led a broad cryptocurrency selloff, shedding 3% to $112,800 as digital assets erased $400 billion in market value. The downturn coincides with a critical inflection point in U.S. Treasury yields, which have historically served as a bellwether for risk appetite.

Two-year bond yields hovering near support levels suggest growing investor caution. 'When yields fall, crypto typically suffers,' noted market analyst Mihir, pointing to the inverse relationship between safe-haven assets and speculative markets. The trend reversal follows months of sideways movement that previously supported crypto's rally.

Federal Reserve policy expectations compound the pressure. Earlier enthusiasm about potential rate cuts has waned, removing a key catalyst for crypto's recent gains. Market participants now watch yield curves for signals - a decisive break below current levels could trigger further capital rotation from volatile assets.

Bitcoin Plunges Below $112,000 Amid $1.7 Billion Liquidation Storm

Bitcoin's price collapsed to $111,760 on September 22, 2025, breaching the critical $115,000 support level that had previously stabilized the market. The 1.5% drop erased recent gains, with the cryptocurrency failing to sustain momentum after briefly touching $117,000 earlier in the week.

The broader digital asset market shed $77 billion in capitalization during the selloff, triggering liquidations for over 400,000 traders. Federal Reserve policy uncertainty and mixed inflation data exacerbated the downturn, though the Fear & Greed Index remained surprisingly neutral at 45.

Technical factors compounded the pressure as Bitcoin formed a Doji candle at resistance. Institutional profit-taking emerged after strong August performance, while spot ETF inflows showed signs of stagnation. Market structure appears fragile as large holders reposition portfolios.

MicroStrategy Doubles Down on Bitcoin Amid Stock Plunge

MicroStrategy's stock (MSTR) tumbled 16% to $323, hitting a five-month low as Bitcoin faced an 8% retreat from recent highs. Undeterred, Executive Chairman Michael Saylor reaffirmed the company's commitment to its Bitcoin-centric strategy, signaling potential additional purchases.

The business intelligence firm now holds 638,985 BTC worth approximately $73.9 billion. Recent acquisitions include 1,955 BTC at $114,562 and 525 BTC at $111,196. Saylor dismissed market volatility as temporary noise, accusing bots of amplifying negativity to benefit short sellers.

"Bitcoin remains the core asset of our treasury strategy," Saylor told podcaster Natalie Brunell. The executive framed current price fluctuations as inconsequential to MicroStrategy's long-term vision of Bitcoin as a store of value.

Bitcoin Longs Surge on Bitfinex Amid Price Drop Below Key Average

Bullish bets on Bitcoin have climbed sharply on Bitfinex, with long positions jumping 20% over three months to 52,774 margin trades. The increase comes as BTC's price dips below its 100-day moving average—a critical support level historically tied to trend reversals.

Leveraged longs typically signal bullish sentiment, but Bitcoin's market has repeatedly turned this logic on its head. Rising longs often precede price declines, as overextended traders face liquidations or discretionary selling. The pattern has played out before: Bitfinex longs frequently move inversely to BTC's price action, making them a contrary indicator rather than a straightforward buy signal.

The current divergence between positioning and price raises red flags. If history repeats, the buildup of leveraged longs could amplify downward pressure, turning optimism into fuel for a deeper correction.

Metaplanet Expands Bitcoin Holdings to Over $2.7 Billion

Metaplanet has significantly increased its Bitcoin portfolio with the acquisition of an additional 5,419 BTC, valued at approximately $632.5 million. This strategic purchase elevates the company's total Bitcoin holdings to 25,555 BTC, surpassing the $2.7 billion mark.

The move underscores Metaplanet's unwavering conviction in Bitcoin's role as a long-term reserve asset. By consistently adding to its position, the firm is cementing its status as one of the largest corporate holders of Bitcoin globally.

Coinbase Aims to Evolve into a Financial 'Super App' Beyond Crypto Trading

Coinbase CEO Brian Armstrong outlined ambitious plans to transform the platform into a comprehensive financial services hub during a Fox Business interview. The exchange's vision extends far beyond digital asset trading, targeting integration of banking, payments, and investment services through crypto-native infrastructure.

Armstrong cited political tailwinds, noting unprecedented bipartisan momentum for crypto legislation in Congress. This regulatory progress could accelerate Coinbase's roadmap, which already includes products like its Bitcoin rewards credit card. The 4% BTC cashback offering directly challenges traditional card networks' fee structures.

The long-term strategy positions Coinbase as a potential primary financial relationship for users. "We want to be a bank replacement," Armstrong stated, emphasizing the super app model's feasibility through blockchain efficiency. The approach mirrors Asian tech giants' financial ecosystems but built on decentralized rails.

BTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators, institutional adoption trends, and macroeconomic factors, here are our projected price targets:

| Year | Conservative Target | Base Case Target | Bull Case Target | Key Drivers |

|---|---|---|---|---|

| 2025 | $135,000 | $180,000 | $250,000 | ETF flows, halving effects |

| 2030 | $400,000 | $800,000 | $1,200,000 | Institutional adoption, regulatory clarity |

| 2035 | $900,000 | $1,800,000 | $3,000,000 | Global reserve asset status |

| 2040 | $2,000,000 | $4,000,000 | $7,000,000 | Network effects, scarcity premium |

BTCC financial analyst Michael emphasizes that 'These projections assume continued adoption as a digital gold equivalent and store of value, with timing and magnitude dependent on regulatory developments and macroeconomic conditions.'